Bankrolling

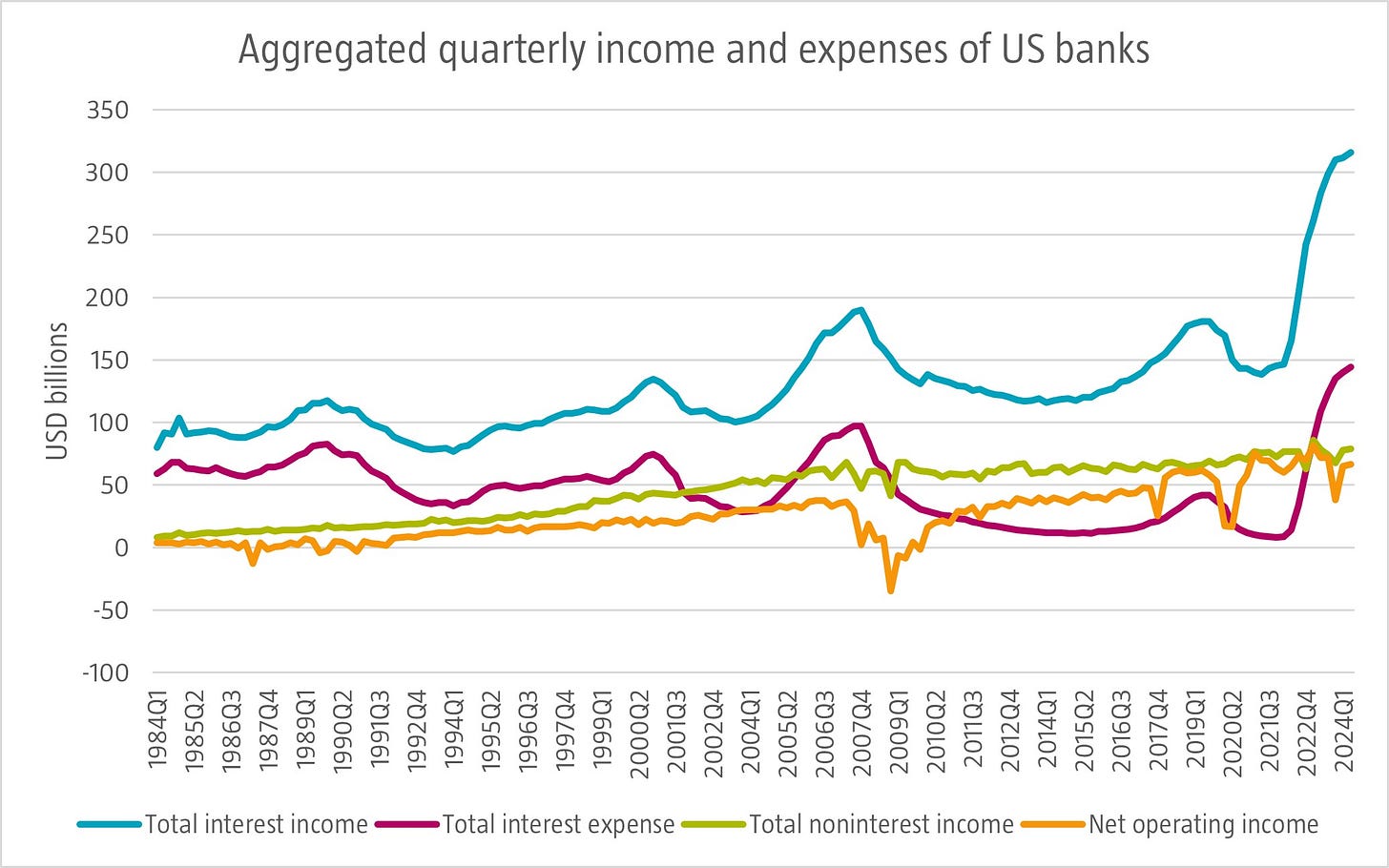

US bank earnings are set to be impacted by decreasing interest rates after a period of steep increases. In Q2 2024, US banks earned a record USD 316 billion in interest income and paid out a record USD 144 billion in interest, netting interest income of USD 172 billion. With interest rates decreasing, one would expect interest income to decrease, but banks have methods to keep interest income high for a while longer such as hedging. However, over time, it will be difficult to retain current high net interest income in the face of lower interest rates. Therefore, some investors are refocusing their attention to banks with a greater share of earnings from steadier and stickier non-interest income such as fees, service charges and advisory. These banks are also likely to be rewarded with higher valuations given their less volatile earnings.

Source: US Federal Deposit Insurance Corporation, October 2024.