Bitcoin ETFs

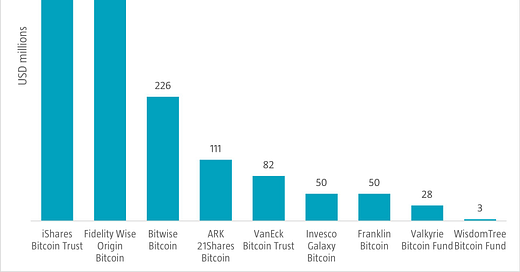

Last Thursday the first Bitcoin exchange-traded funds (ETFs; tracking Bitcoin spot prices instead of futures contracts) were listed in the US. It marked a milestone for the cryptocurrency industry, which has been seeking regulatory approval for years. The US Securities and Exchange Commission (SEC) long doubted whether to approve these ETFs and the SEC board ultimately voted with three members in favor and two against. The new ETFs aim to offer investors a more convenient and cost-effective way to gain exposure to Bitcoin. Some believe the ETFs may attract more institutional and retail investors to the cryptocurrency space as they offer a regulated and transparant vehicle to gain exposure to Bitcoin. So far the new Bitcoin ETFs have assets of about USD 1.5 billion compared to a total market capitalization of Bitcoin of USD 836 billion.

Source: Bloomberg, January 2024.