Cashing out

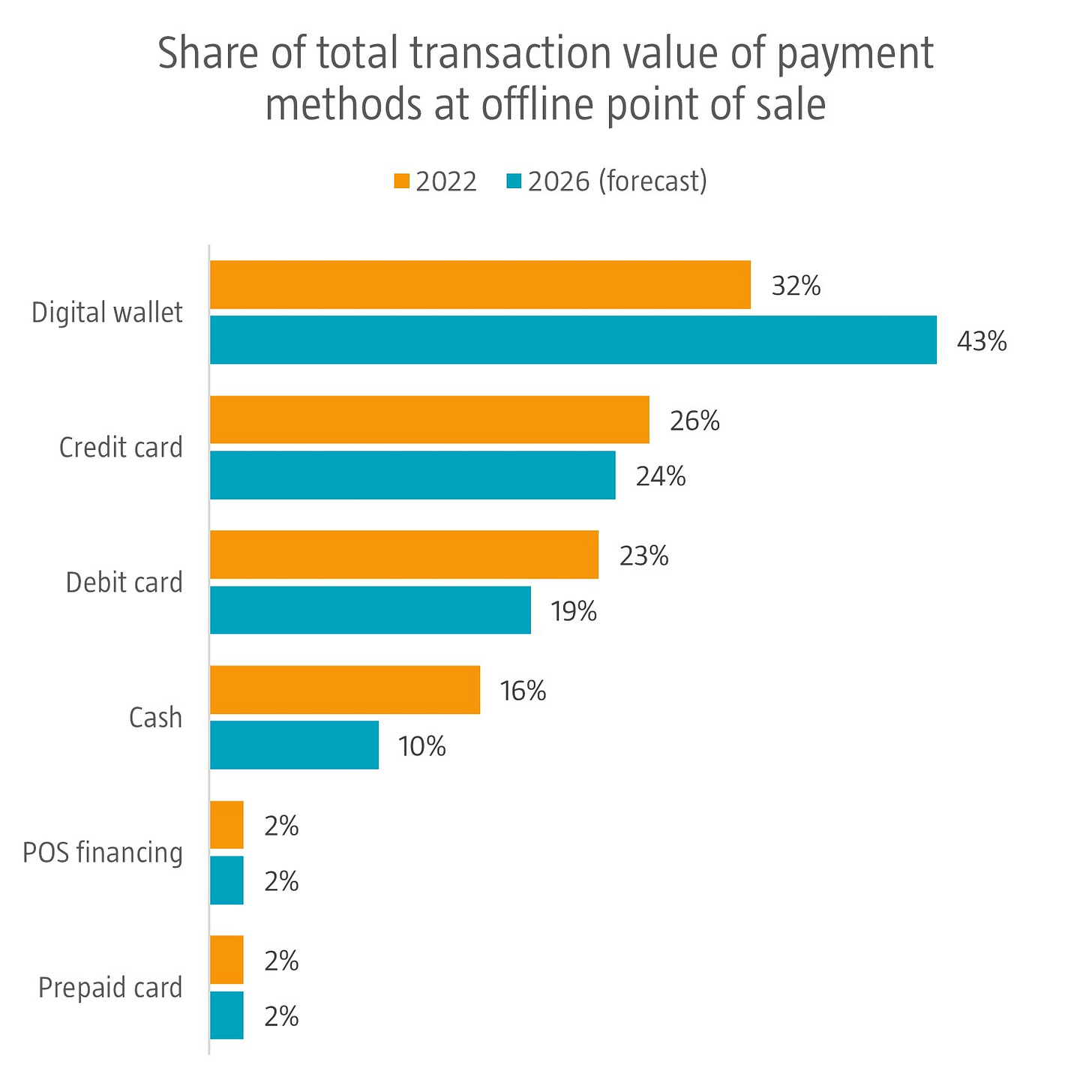

Cash is still a relevant payment method, despite global cash transactions values shrinking from USD 12 trillion in 2018 to USD 8 trillion in 2022, a decrease of 33%, according to global payments services provider FIS. At offline points of sales such as stores, cash makes up 16% of total transaction value but this is forecast to drop to only 10% by 2026.

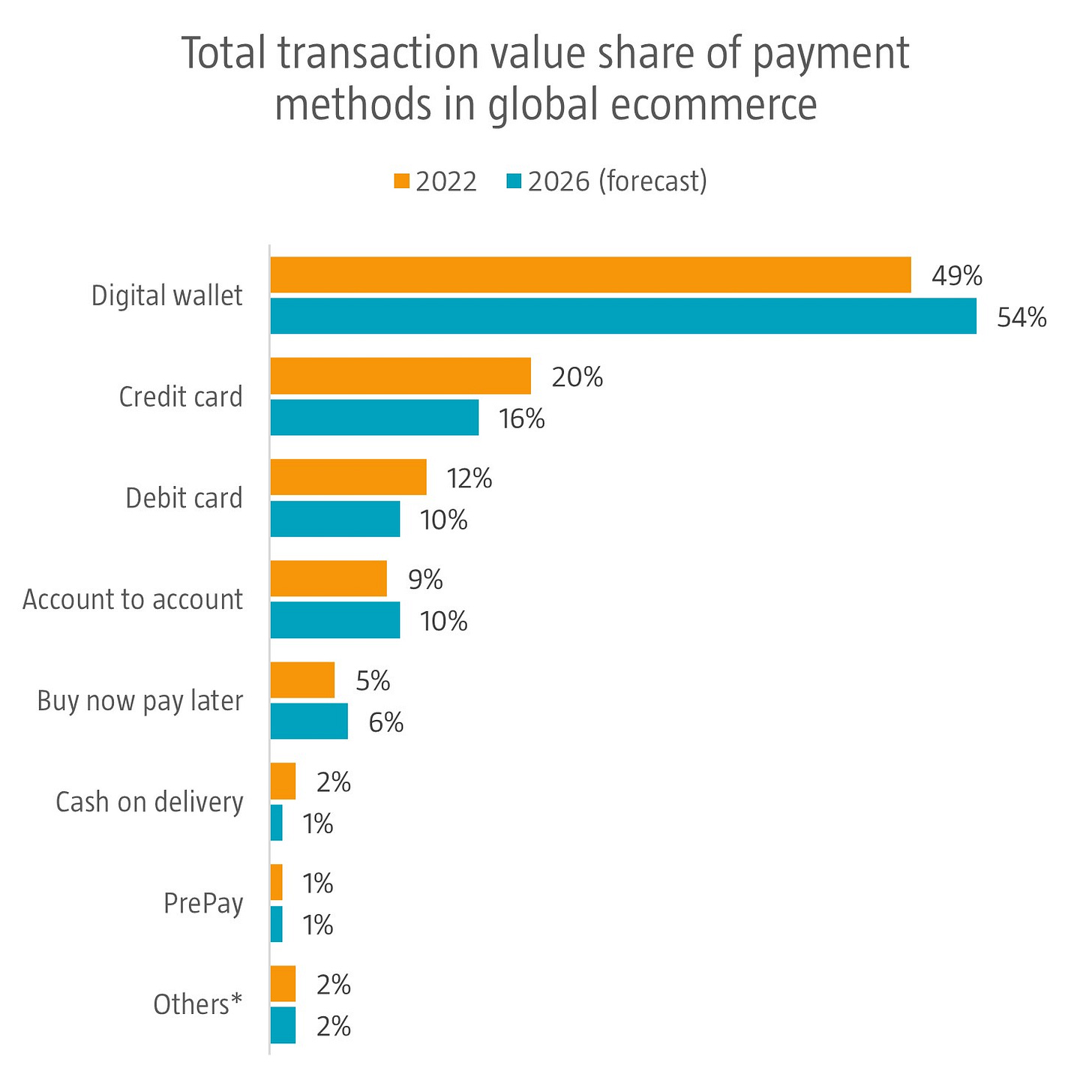

The shift to digital payment methods continues unabated. Digital wallets in particular are gaining shares of transactions at the expense of cash and cards. FIS forecasts digital wallets to have 54% shares of transactions in global ecommerce and 43% in offline points of sale by 2026. In the US, digital wallets are offered by PayPal, Apple and Google, but also by challengers like Shopify and Block. Digital wallets already account for 32% of ecommerce payments in the US up from 14% in 2014, surpassing credit cards at 30%. China is a leader in digital wallets with Alibaba and Tencent being the largest providers. In Latin America, Mercado Libre is making inroads. Across the globe, we see these digital wallet providers embed additional financial services such as ‘buy now pay later’ and working capital financing in their product.

Source: FIS, April 2023.