Coming home

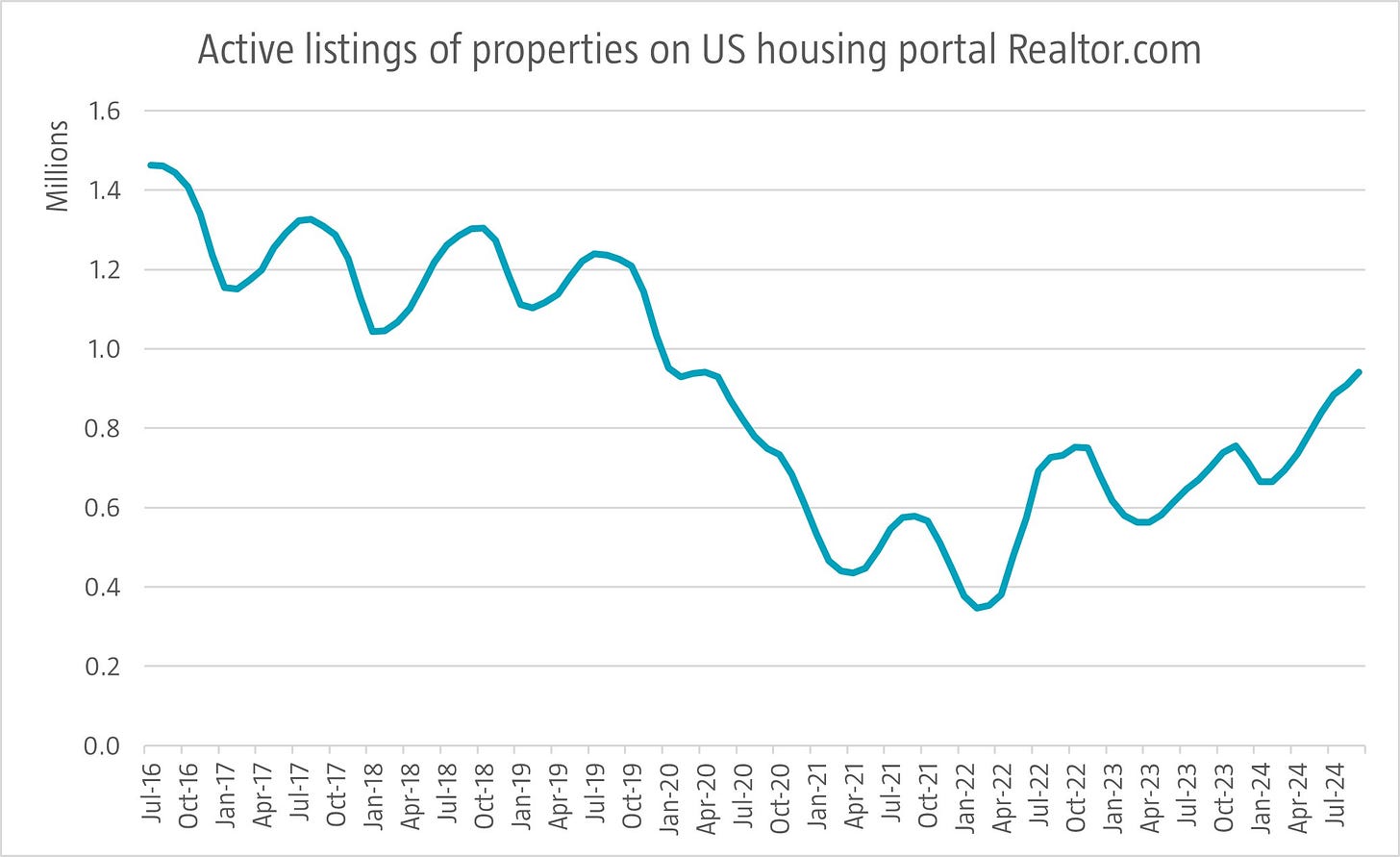

The US market for existing homes has been in gridlock since 2022 with annual existing home sales dropping a third from about 6 million to around 4 million. A key driver for current low existing home sales is many home owners having a low fixed rate mortgage. The average interest rate for outstanding residential mortgages is 4.1% compared to new 30-year fixed rate mortgages (the most common mortgage form in the US) at 6.8%. Following Fed interest rate cuts, mortgage rates are coming down gradually. This could lead to more homeowners putting their house up for sale as the gap between their current mortgage and a new one has decreased. Based on data from US home property portal Realtor.com that is what’s happening, with active listing increasing to 940,000 in September. Increasing housing turnover tends to be beneficial for home improvement retailers, furniture companies and some building materials suppliers.

Source: Realtor.com, October 2024.