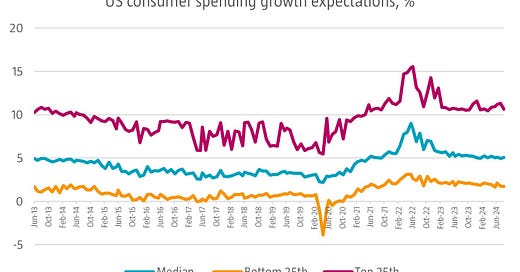

Consumer expectations

While stock market volatility has jumped, and economists fervently debate the appropriate pace of interest rate cuts, consumer expectations remain markedly stable. According to the US Federal Reserve Bank of New York’s August 2024 Survey of Consumer Expectations, across employment, inflation and spending plans, the outlook among US consumers has remained largely unchanged over the last year. Median inflation expectations over the next year remain at 3.0%. Expectations for earnings growth over the next year rose slightly from 2.7% to 2.9% in the July survey. The expected probability of losing one’s job in the next year decreased by 1.0 percentage point to 13.3%. The median expectation for household spending growth ticked up modestly to 5%, a level that has been fairly consistent over the past year. The only concerning component of the report relates to credit, where expectations that consumers will miss a credit payment in the coming three months rose 3/10 of a percent to 13.6%, the highest level since April 2020.

Source: US Federal Reserve Bank of New York, September 2024