Consumer pulse

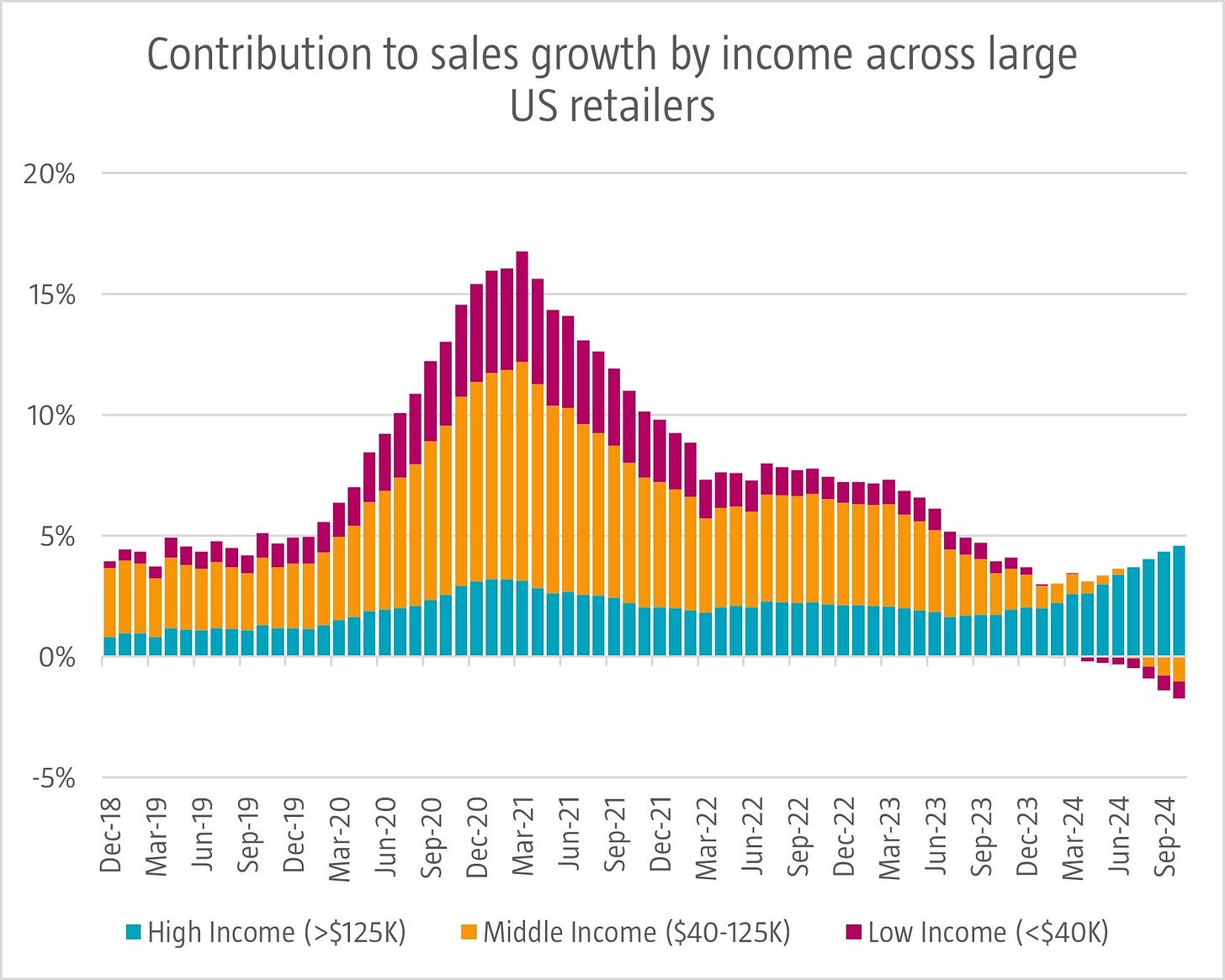

US consumer spending was very resilient in 2024, although spending growth is being driven by the high-income consumer. This affluent cohort has been supported by rising asset values – home prices and stocks – while low- and middle-income consumers slowed in 2024 despite healthy wage growth, as they were disproportionately impacted by inflation. It is likely that those trends continue in 2025, although moderating inflation should give more room to spend for the lower-income consumer. Good news is also coming from the US labor market with the unemployment rate still hovering around the historical low 4%. This could sustain buoyant spending levels. We wrote more about the consumer trends of 2025 here including about retail media, entertainment and injectable aesthetics.

Source: Barclays, Numerator, December 2024.