Deals on a lifeline

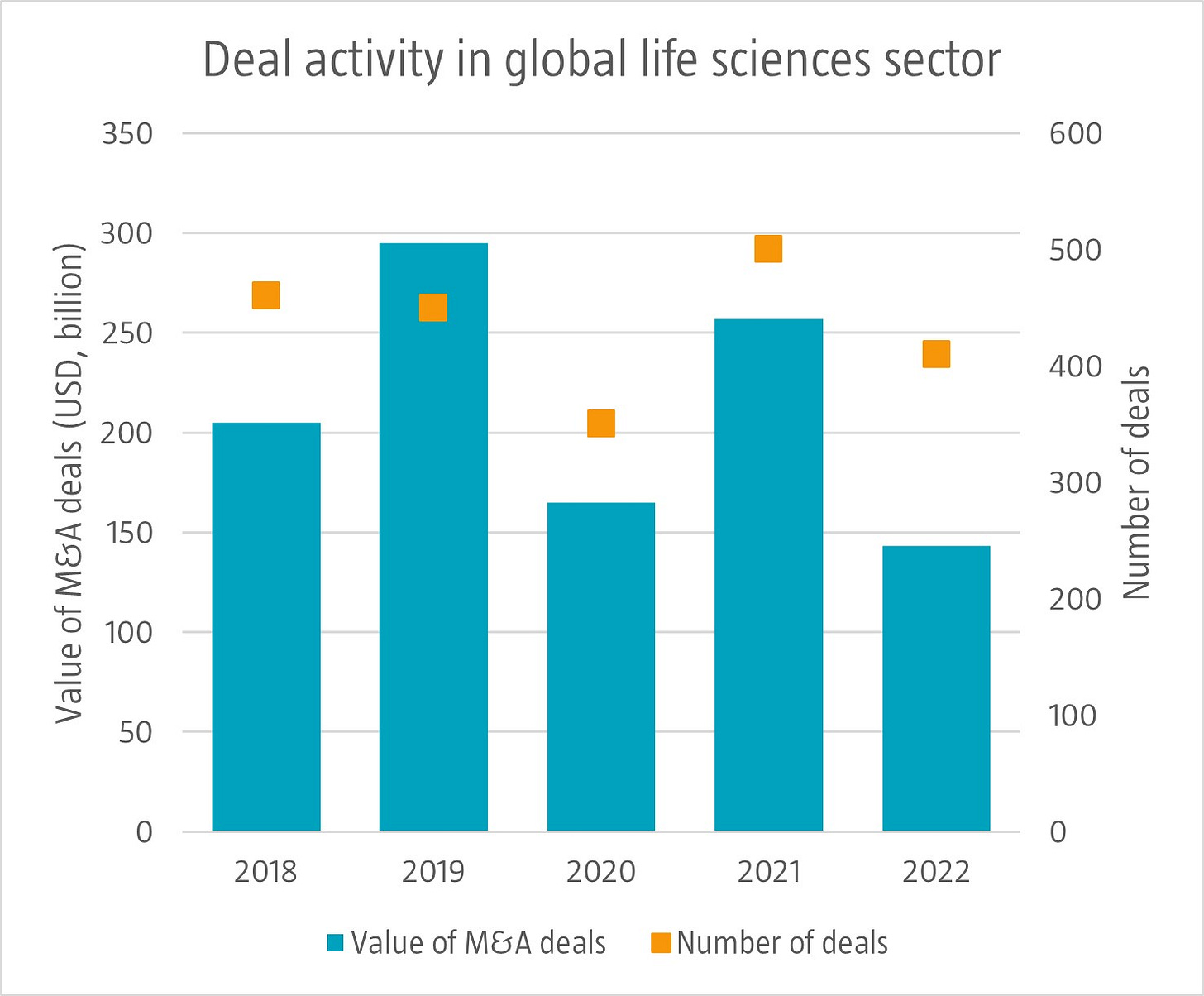

Mergers and acquisitions activity in the life sciences sector has slowed down substantially due to macroeconomic turbulence, capital market uncertainty, and a more difficult funding environment. Aggregate spending on M&A in the sector dropped 44% to a five year low of USD 143 billion in 2022. The largest M&A deal was Amgen’s USD 28 billion takeover of Horizon Therapeutics following a bidding war with Sanofi and Johnson & Johnson. In March 2023 deal activity looked to pick up with Pfizer announcing the acquisition of Seagen for USD 46 billion. However, aggregate deal value is still down in the last twelve months according to recent numbers from PwC. It remains unclear when the life sciences sector will emerge from this “biotech winter”.

Source: IQVIA, PwC, 2023.