Debt due

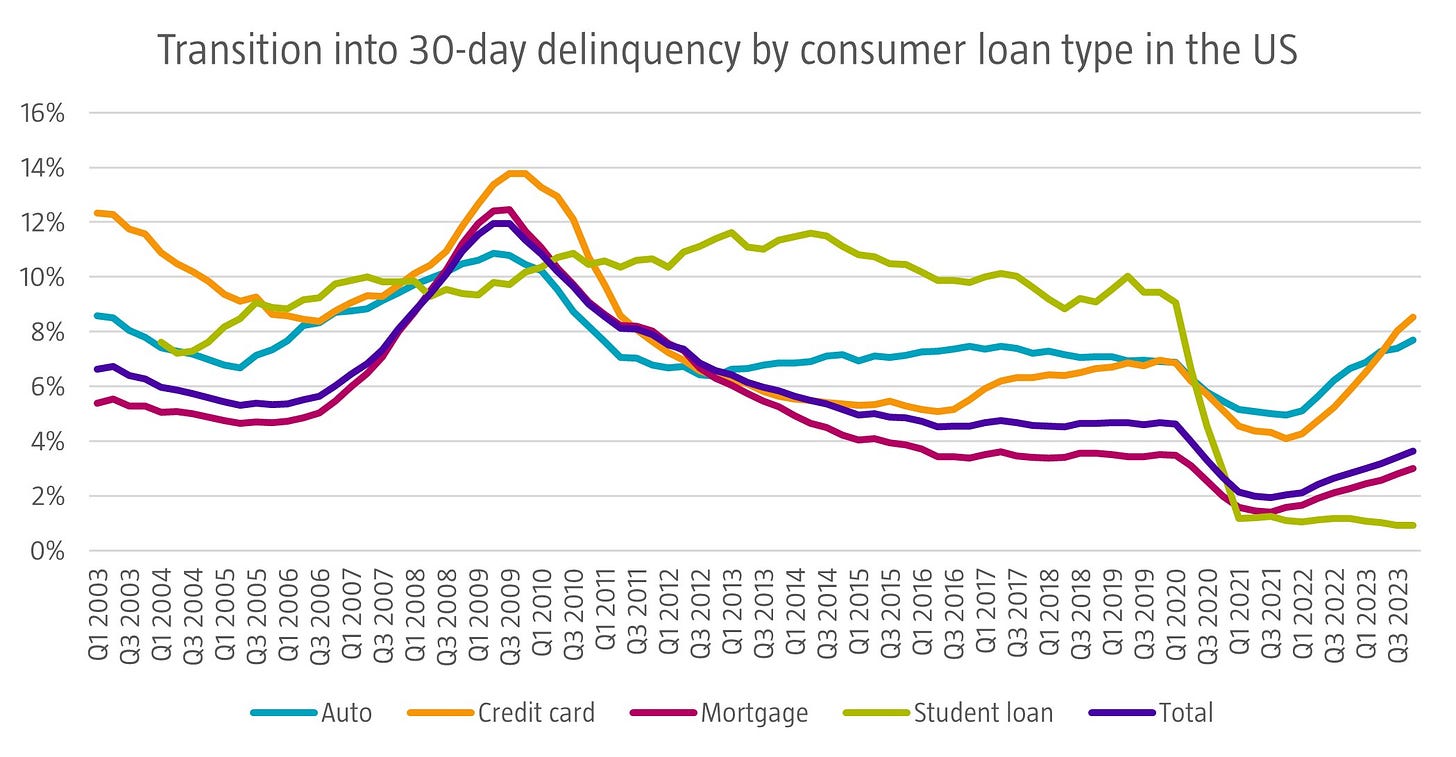

In the US, total household debt grew 3.6% year-over-year in the fourth quarter of 2023 and reached a record high of USD 17.5 trillion. The vast majority of that, about 70%, is mortgage debt. Auto loans make up 9%, credit cards 6% and student loans 9% and other types of loans take up the remaining 6%. Although most indicators point to financially healthy US consumers, some appear to be having more difficulty repaying debt. The flow into 30-day delinquency is increasing, especially in the case of credit card and auto debt. In fact, both have risen above pre-pandemic levels. Nonetheless, 96.9% of total debt outstanding remains current.

Source: US Federal Reserve Bank of New York, February 2024.