Japanification

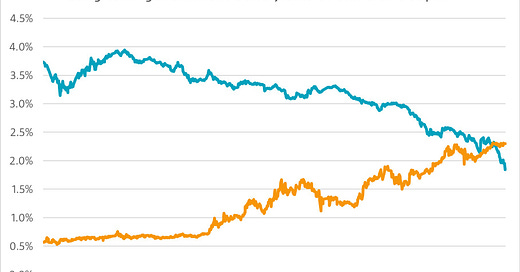

Chinese long-term government bond yields have dropped substantially in recent years, suggesting investors expect slow economic growth and low inflation. China’s current economic and demographic trajectory has resemblance to Japan’s experience in the 1980s and 1990s. Some would say China is undergoing “Japanication”. Both nations faced slowing economic growth while population growth was slowing and it eventually turned negative. China is trying to increase domestic consumption and production of advanced technologies as it tries to diversify from relying on manufacturing, construction and exports. So far, consumer’s willingness to spend remains low though partially triggered by lower housing prices. To some extent, China’s real estate problems and high debt levels resemble Japan in the early 1990s that eventually led to the “Lost Decade”. Perhaps taking some lessons from Japan’s experience, China’s government and central bank are trying to stimulate economic growth and consumption with increasingly larger actions. Our colleague Arnout van Rijn wrote a good piece about the (dis)similarities of Japan and China that can be read here.

Source: Bloomberg, January 2025.