More mobile money

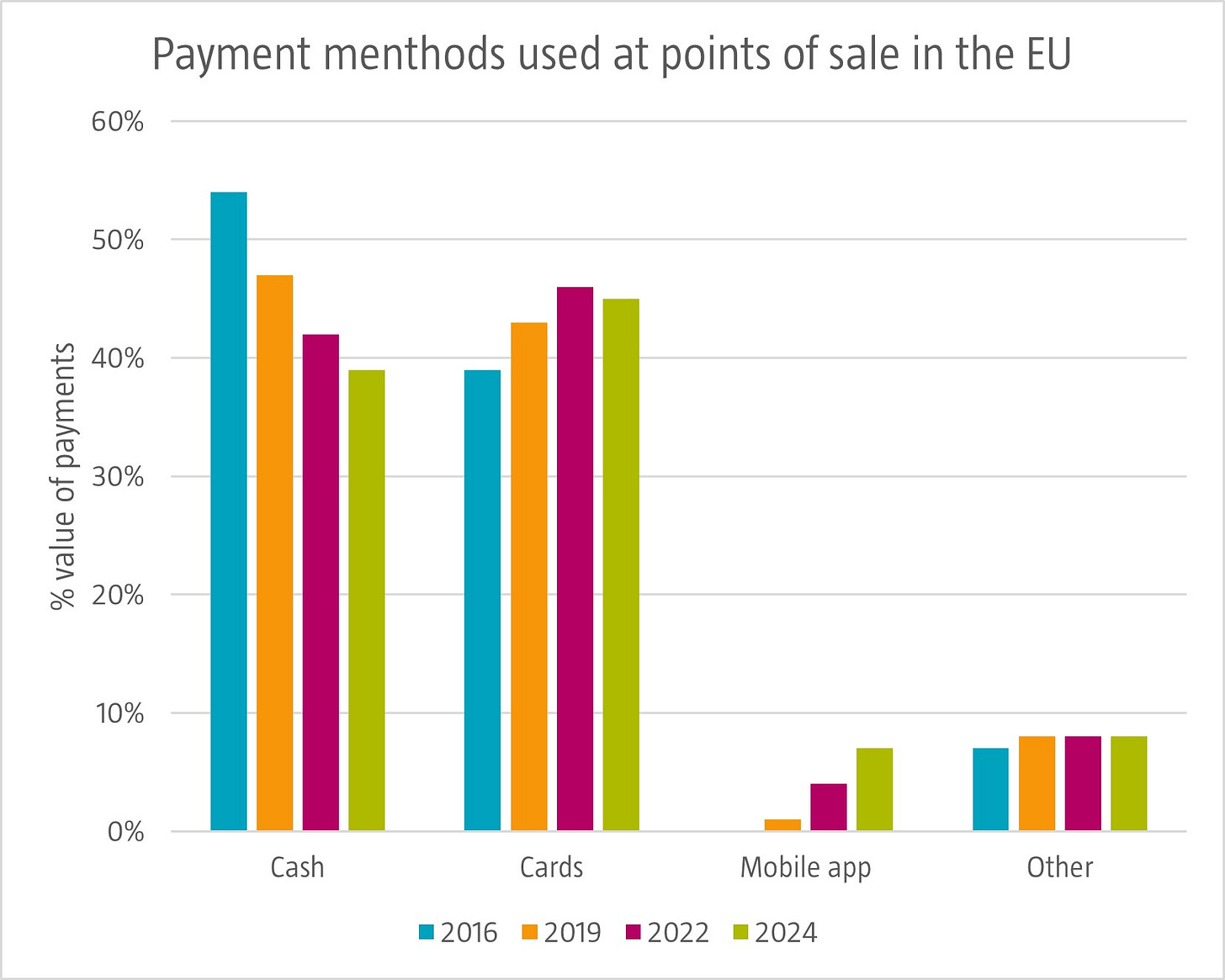

EU consumers used mobile payments at points of sale (POS) more often in 2024 compared to 2022, instead of cash and cards. Still cash and cards remain large with 52% and 39% of payment value at POS, respectively. Bear in mind that mobile payments often involve a digital card e.g., a debit card from a bank in an Apple Wallet. In the Netherlands, 17% of payment value is made through mobile apps and only 17% through cash, making it the most skewed distribution in Europe. Some countries, including Austria, Slovenia and Lithuania, still heavily make use of cash with between 56% and 59% of value paid in cash. As consumers increasingly use their mobile devices for payments, some power may shift from banks and card issuers to mobile devices or payment app companies.

Source: European Central Bank, January 2025.