Mortgage uptick

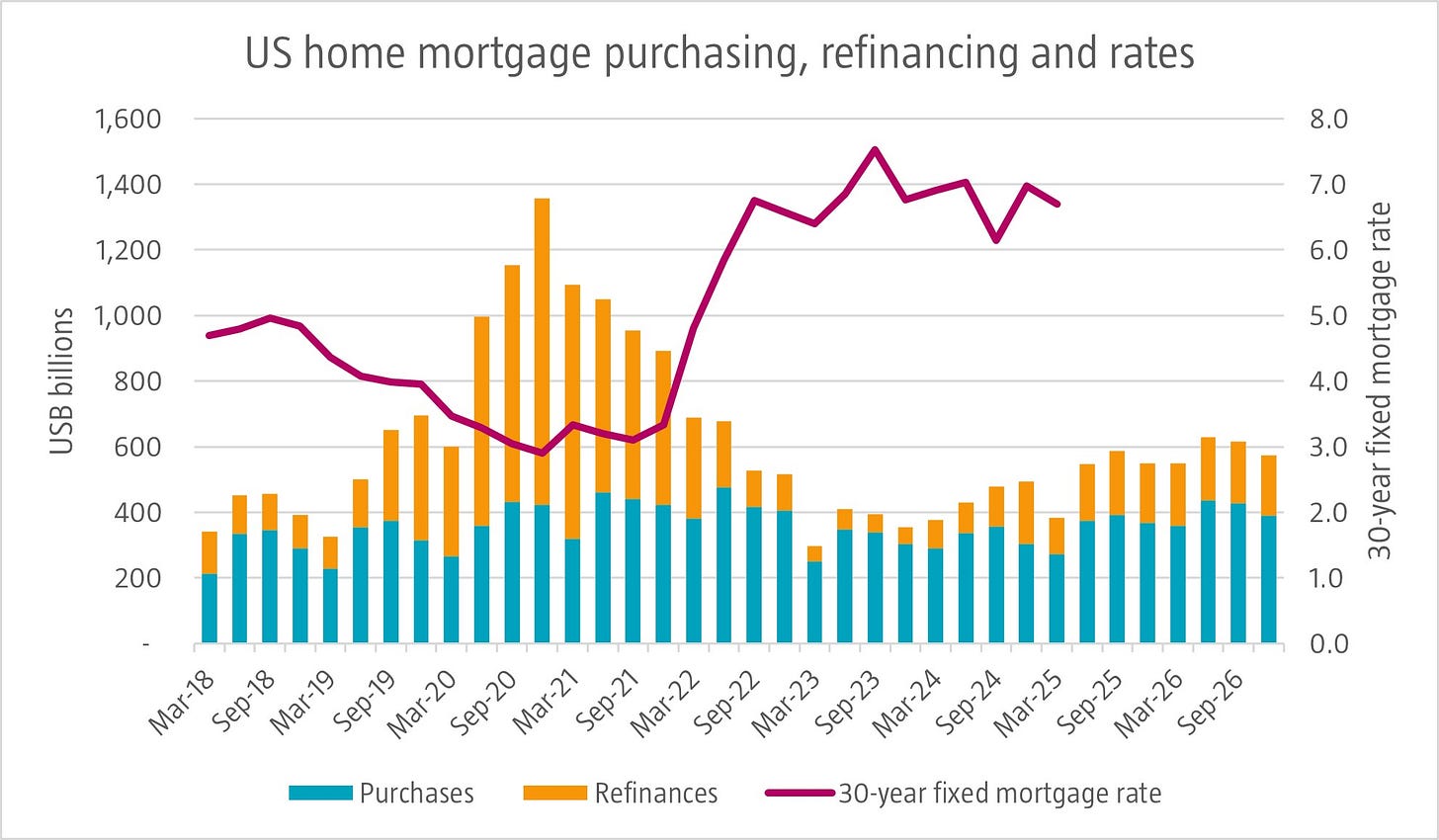

Activity in the US home mortgage market has picked up slightly in Q1 with a 2% increase in home loan purchases and refinancing compared to a year ago. New home loans volume still decreased 7% from a year ago, but refinancing was up 30%. The main driver is mortgage rates. The most common mortgage in the US is a 30-year fixed one, and its rate has decreased from a peak of 7.5% in Q3 2023 to 6.7% in Q1 2025. Looking back further though, US home mortgage market activity is still down 72% from its peak in Q4 2020 when the 30-year mortgage rate hit rock bottom at 2.9%. The forward path of interest rates is unpredictable, especially in this economic environment with a lot of uncertainty. But if lower interest rates materialize, this would likely lead to a significant pick-up in activity for home building, home improvement and all sorts of companies involved in home financing, such as data and analytics firms servicing mortgage lenders. The US Mortgage Bankers Association is optimistic and forecasts increasing activity in both home loan purchases and refinancing in the coming years.

Source: Mortgage Bankers Association, Bloomberg, May 2025.