Office on the off-ramp

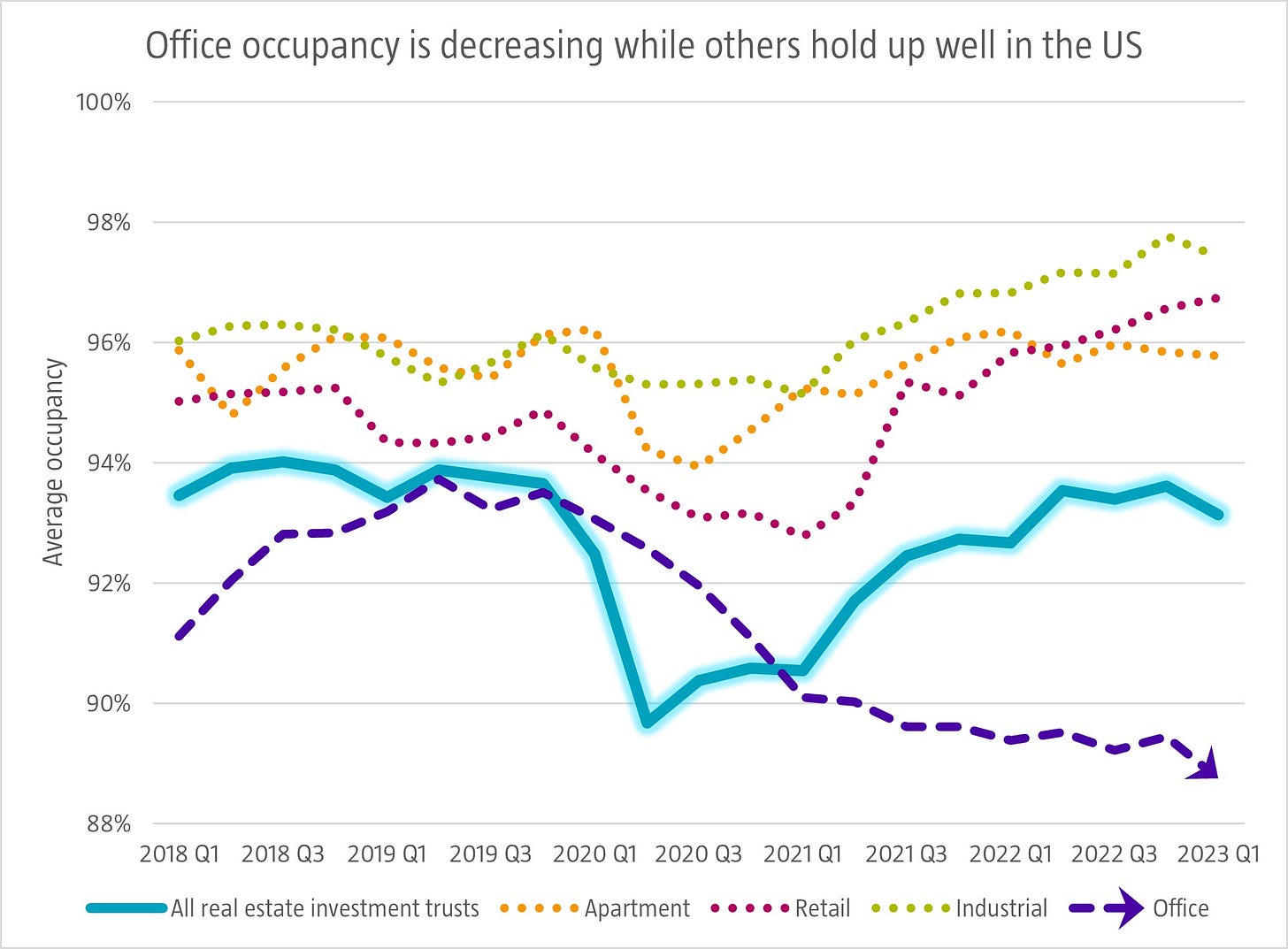

Office real estate disruptor WeWork shares declined sharply this week after the company stated it has ‘substantial doubts’ over its future. It’s not the only office real estate company dealing with a decline in business. Average occupancy rates for US real estate investment trusts (REITs) focusing on office space have declined from around 93% in 2019 to 89% in the first quarter of 2023. REITs are a common vehicle to hold real estate stocks and their shares are publicly traded. One might have expected occupancy rates to recover after the pandemic as apartments, retail and industrial have with record occupancy levels. But in the office segment the opposite has happened, occupancy continues to decline. Many companies have adopted a policy of hybrid working and need less permanent office space than before. Perhaps owners should upgrade their properties as modern sustainable office space demand is strong, according to our real estate colleagues.

Source: National Association of REITs (NAREIT), August 2023.