Paycheck anxiety

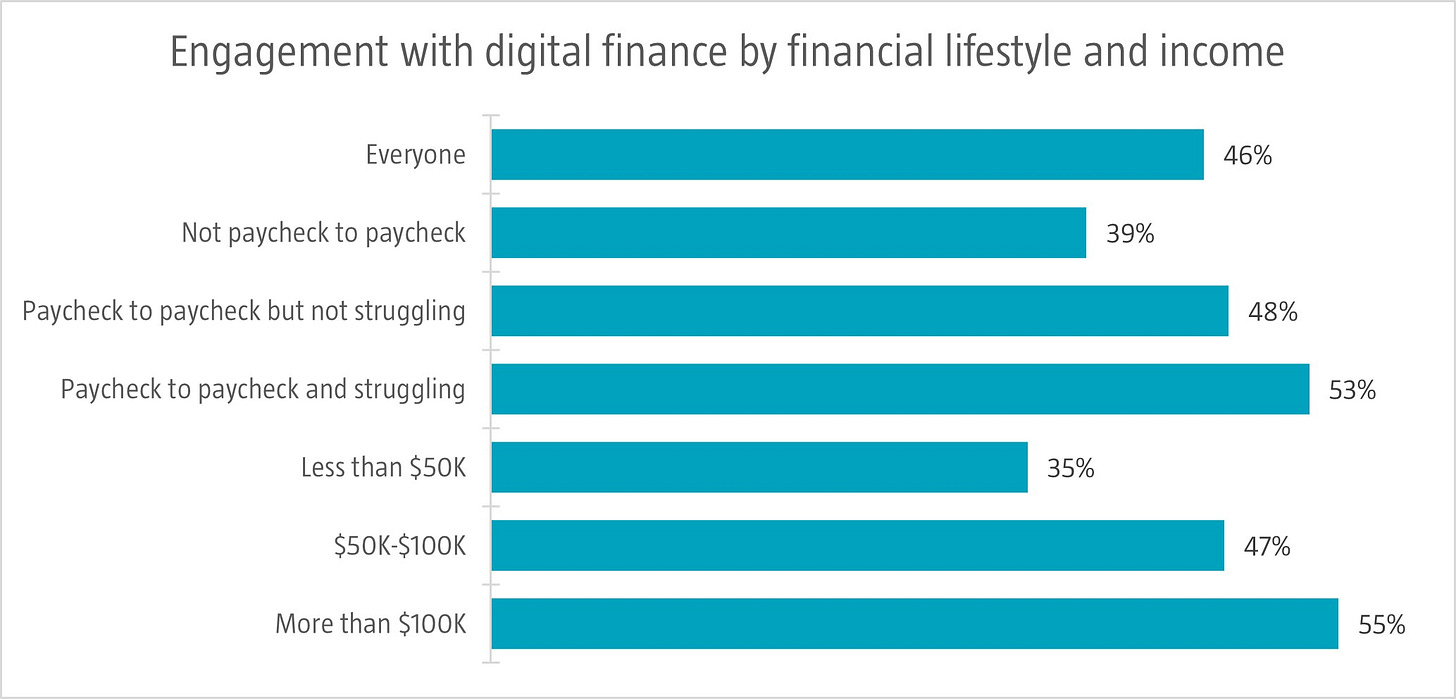

Across all income segments, consumers who say they are living paycheck to paycheck with issues paying their bills are more digitally engaged with financial services than those who are not, a recent survey by PYMNTS in the US shows. These consumers have higher engagement with neobanks, digital wallets and arrange more of their finances on their mobile devices. For instance, 15% of those struggling financially say they use services such as PayPal, Venmo, Chime and Cash App as their primary bank account compared to an average of 13% in the survey. Importantly, consumers living paycheck to paycheck generally have lower-incomes, but in 2023 about 50% of those earning more than USD 100,000 annually also report they are living paycheck to paycheck, up from 37% in 2022.

Source: PYMNTS Intelligence, May 2024.