Risky business

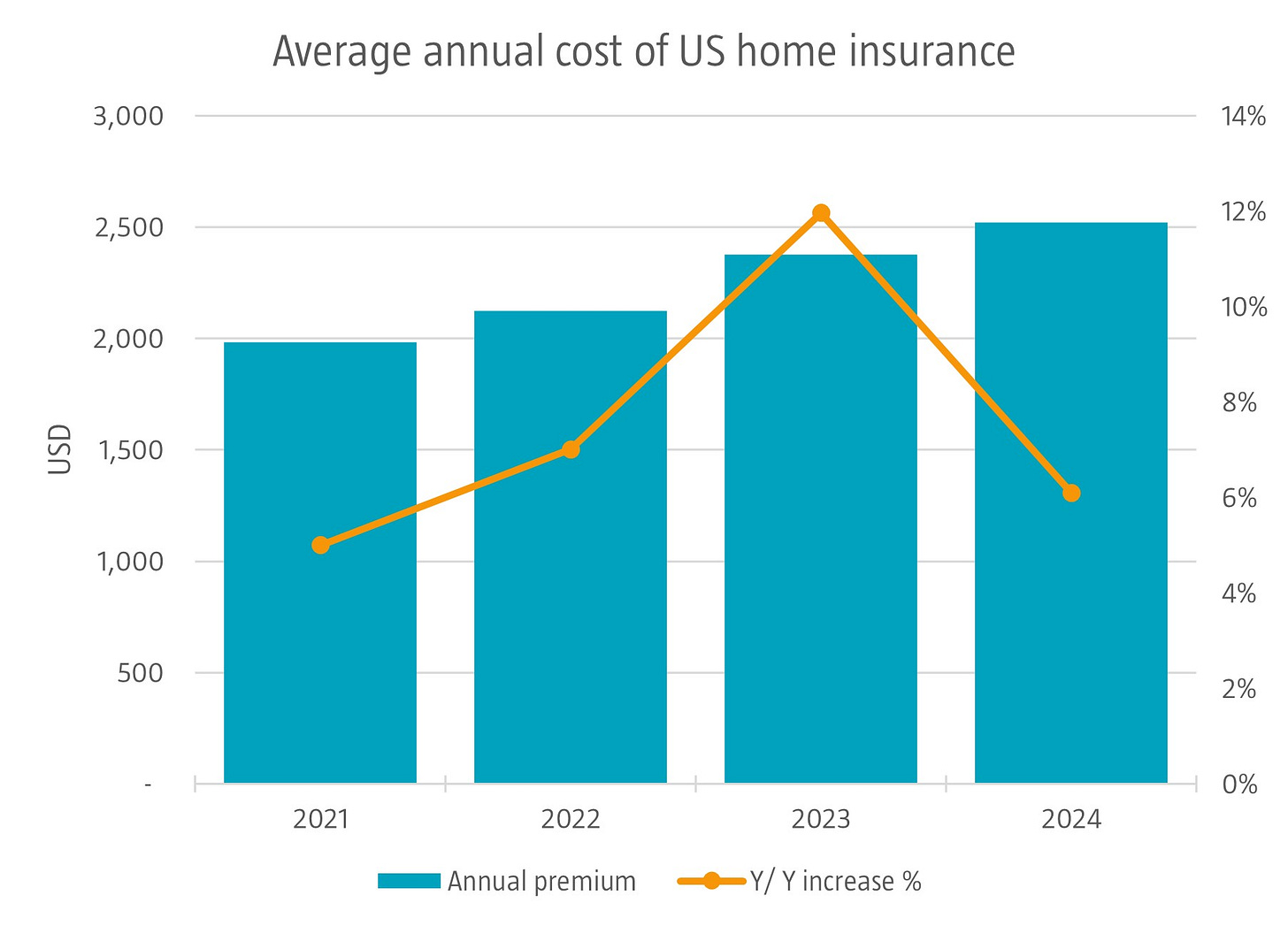

Extreme weather events that cause over 1 USD billion in economic damage are becoming more common. As of August, the US had already faced 19 such extreme weather events, with their collective costs totaling an estimated USD 37 billion. With storm season still ongoing and adding the impact of hurricanes Helene and Milton that hit over the last month, the US may be on track to surpass the record of USD 383 billion in weather-related losses set in 2017. Given low rates of flood insurance coverage, private insurance companies are expected to cover less than 10% total damages, leaving the remainder to federal and state government, deepening their debts. Only a small percentage of homes in flood-prone areas have coverage, making rebuilding difficult. In states like Florida, where public flood insurance is stretched thin, another major hurricane could lead to an insurance collapse and housing market issues. Nationwide, nearly half of US homes are at risk from extreme weather, and insurance premiums have jumped 26% between 2021 and 2024. As climate risks increase, banks are offloading risky mortgages, and housing markets could be severely overvalued if these risks are taken into account.

Source: Insurify, April 2024.