Save now, spend later

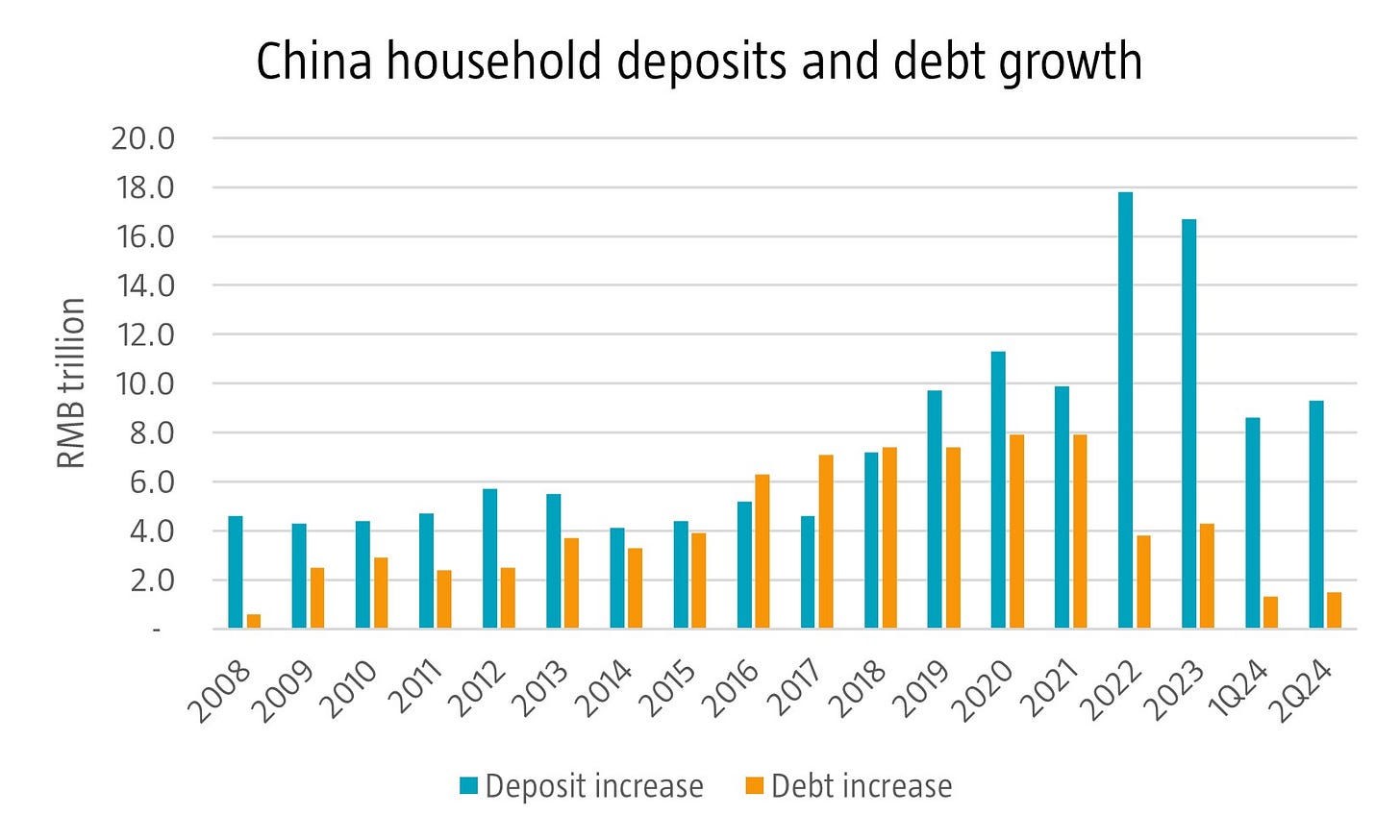

A recent stock market rally in China, sparked by government stimulus measures, was short lived as investors remain wary of deeper structural issues. Nevertheless, with the prospect of further policy adjustments, some investors continue to look for signals to turn bullish again in China. Deflationary pressures persist, and consumer confidence remains weak with lower property values impacting the wealth effect. Signaling a preference for saving over spending, deposit growth surged 10.5% year-on-year in September and household debt has stabilized. When the economy improves, those savings should support stronger spending in the future. While the timeline for recovery is uncertain, stronger demand-side measures and continued government support could gradually improve conditions, opening the door to a more sustained rebound, benefiting discretionary end markets such as luxury and automotive.

Source: CLSA, PBOC, WIND, October 2024