Shiny bars

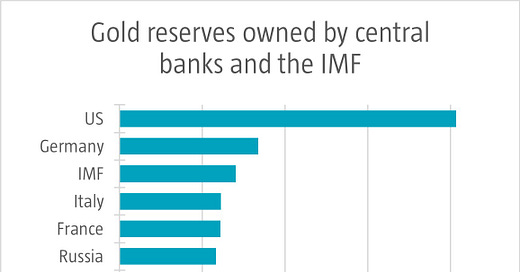

Rising gold prices have significantly benefited central banks globally. Recently, gold prices soared to USD 3,400 per ounce, greatly increasing the value of gold reserves held. For instance, the US Federal Reserve, which possesses approximately 8,133 metric tonnes of gold, now finds its reserves valued at about USD 975 billion. The International Monetary Fund (IMF) also holds substantial gold reserves dating back to its inception in 1944 when member countries paid part of their initial contribution in gold. In recent times. Countries like Poland, which added 146 metric tonnes to its reserves, along with Azerbaijan, India, Türkiye, and China, have all increased their gold holdings. Conversely, some countries have opted to sell part of their gold reserves. Notable sellers include Singapore and Kazakhstan, each divesting around 25 tonnes. Singapore’s central bank is likely capitalizing on high gold prices and increasing its reserves of other assets, including foreign currency. Kazakhstan is selling gold to buy US dollars its national currency, the tenge (KZT).

Source: World Gold Council, June 2025.