Size matters

Smaller market capitalization stocks have substantially underperformed their mega-cap counterparts over the last decade. However, according to recent research conducted by our quantitative investment strategies team, a longer term perspective suggests that smaller caps have big potential. The research notes the underperformance has been more a function of changes in relative valuation than of deteriorating fundamentals. In particular, the difference in valuation between small and large-cap stocks is now the widest in over 20 years.

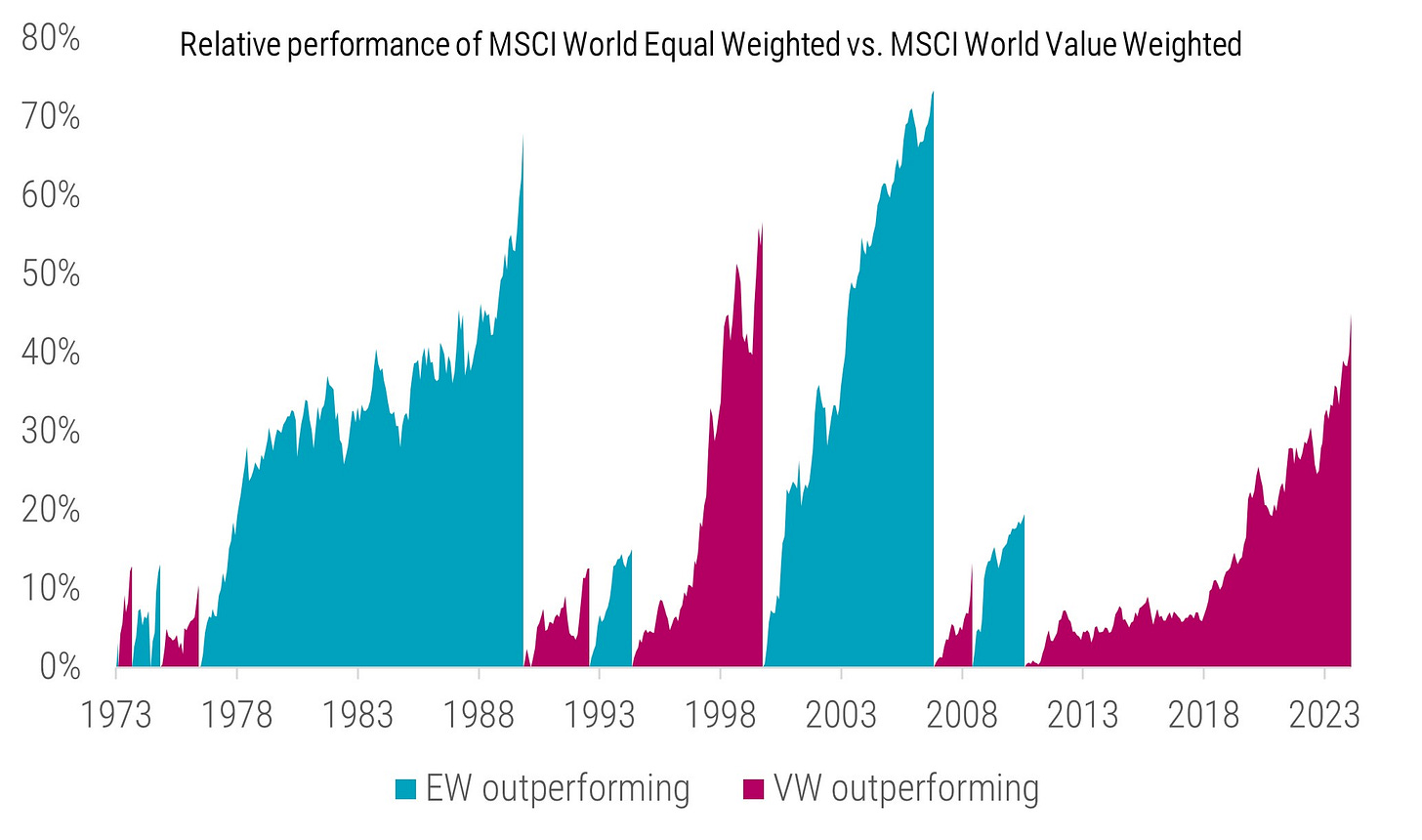

Source: Robeco, LSEG, MSCI. The figure shows the relative performance MSCI World Equal Weighted Index vs. the MSCI World Index. Performance is measured via the total return index and the sample period is May 1973 to June 2024.