Sketched, fintech and financials in 2024

Before taking a short holiday break, this week we revisit key trends from the past year across technology, the consumer, the economy, sustainability, and financials.

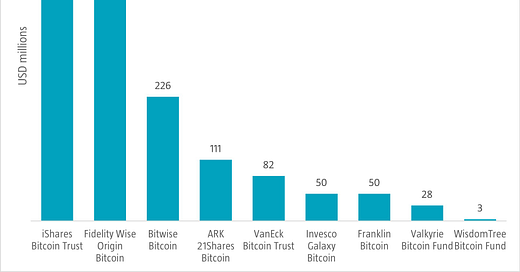

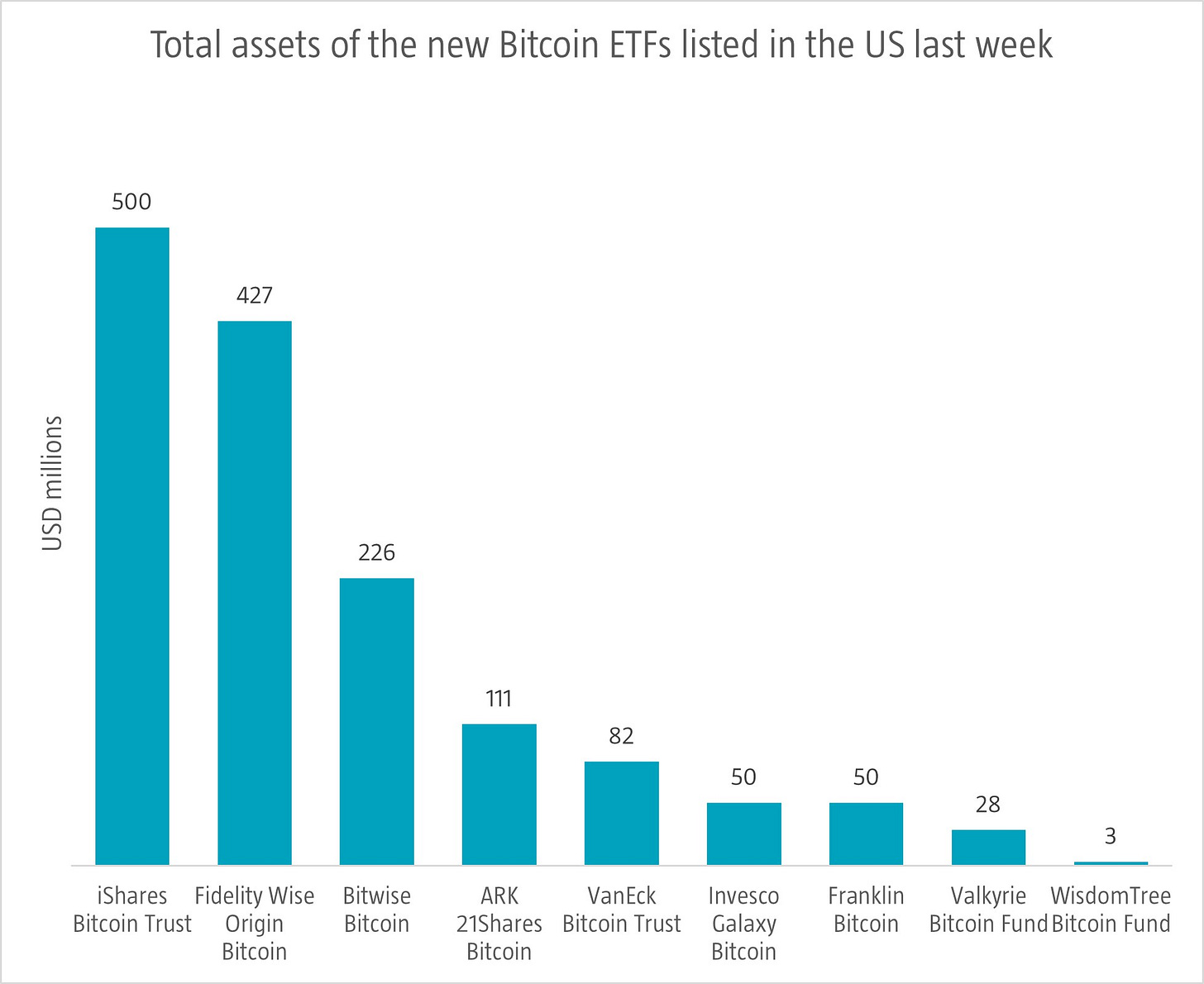

In January of this year, after a long-running debate, the US Securities and Exchange Commission (SEC) voted with three members in favor and two against to approve the listing of Bitcoin exchange-traded funds (ETFs). Many believe the ETFs will attract more institutional and retail investors to the cryptocurrency space as they offer a regulated and transparent vehicle to gain exposure to Bitcoin. Within the first week of listing in January, the new Bitcoin ETFs attracted assets of USD 1.5 billion. The move appears to have been well timed: since the listings, the value of Bitcoin has more than doubled.

Source: Bloomberg, January 2024.

The re-election of President Trump triggered renewed optimism in the digital asset industry. Adoption of digital assets has been trending up for a while, but could accelerate, especially if a more lenient regulatory environment materializes. Data from Visa and Dune shows that recently, unique addresses (a proxy for users) in public stablecoin and decentralized finance blockchains reached an estimated 30 million and 18 million, respectively.

Source: Visa, Allium, Dune, November 2024.

Neobanks are challenging traditional banks with their digital-only banking services and have been growing fast in the last few years. For instance, both Sweden’s Klarna and Brazil’s Nubank have surpassed 100 million customers. Revenue growth has also been high for most neobanks with some doubling revenue over the last two years. As with most new industries, the challenge is turning a profit. According to consultancy BCG, only 23 out of 453 neobanks were profitable in 2023. You can read more about neobanks here.

Source: company filings, August 2024.

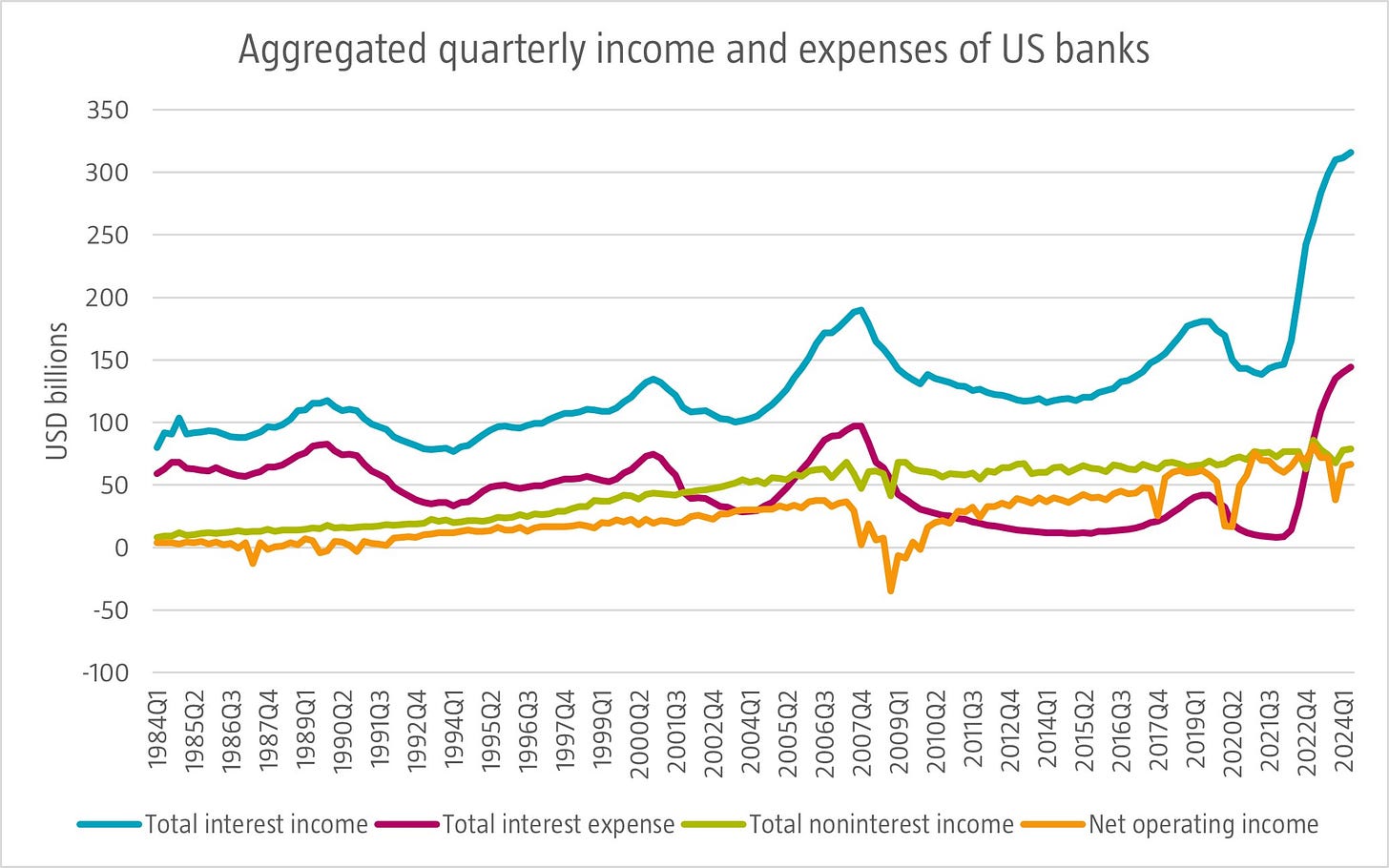

US bank earnings are set to be impacted by decreasing interest rates after a period of steep increases. In Q2 2024, US banks earned a record USD 316 billion in interest income and paid out a record USD 144 billion in interest, netting interest income of USD 172 billion. With interest rates decreasing, one would expect interest income to decrease, but banks have methods to keep interest income high for a while longer such as hedging. However, over time, it will be difficult to retain current high net interest income in the face of lower interest rates.

Source: US Federal Deposit Insurance Corporation, October 2024.