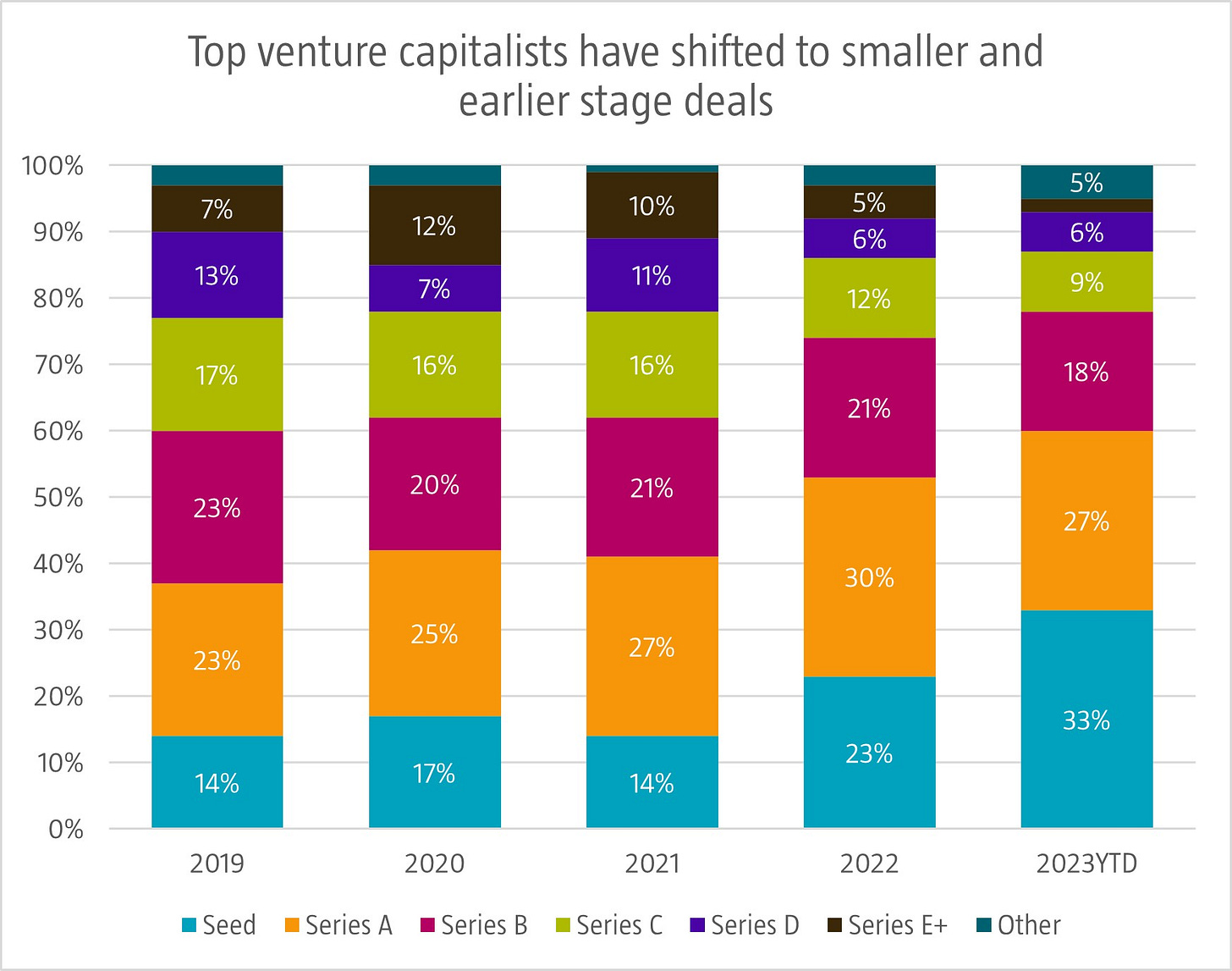

Sowing seeds

Top venture capitalists are doing less deals and have shifted to smaller and earlier stage deals. Whereas in 2021 they did 1,031 venture capital deals, year-to-date in 2023 they only did 244. Median deal size has decreased from USD 44 million in 2021 to USD 18 million in 2023, the lowest level since 2016. This is mostly driven by much fewer follow-on investments in more mature companies i.e., series C, D, E and above. The number of seed stage deals has also decreased but less than the later stage deals and thus their share of deals has increased from 14% in 2021 to 33% in 2023. So, although deal making is slower, venture capitalists are still funding a substantial number of younger companies.

Source: CB Insights, September 2023.

Note: top venture capitalists are defined as a16z, Accel, Sequoia Capital, Insight Partners, and General Catalyst.