Spending through uncertainty

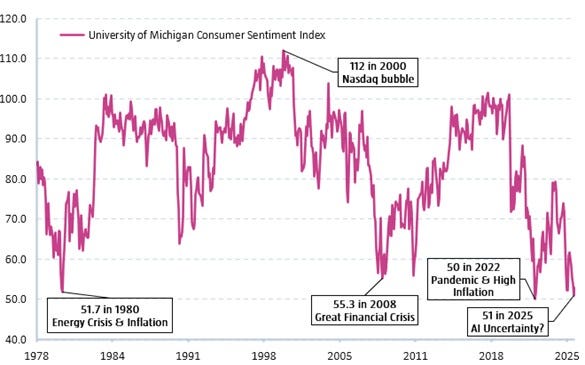

Despite strong economic growth (the Bureau of Economic Analysis reported US GDP rose at a 4.3% annual rate last quarter), consumer sentiment remains low because people focus on immediate financial pressures like high prices (inflation), increased interest rates, and housing costs, which erode purchasing power and income and make consumers feel poorer. This makes the ‘kitchen table’ experience feel worse than macro data suggests. On top of that, continued advances in artificial intelligence makes job security feels less certain. This has created a disconnect where robust spending occurs despite a pessimistic medium term outlook, as consumers prioritize value and struggle with daily affordability despite overall economic strength. Consumers perceive softening job creation, slower hiring, and uncertainty about job security as impacting their confidence. Read more about the outlook for consumer spending, safety and security in this article.

Source: University of Michigan, January 2026.