The leapfrog effect

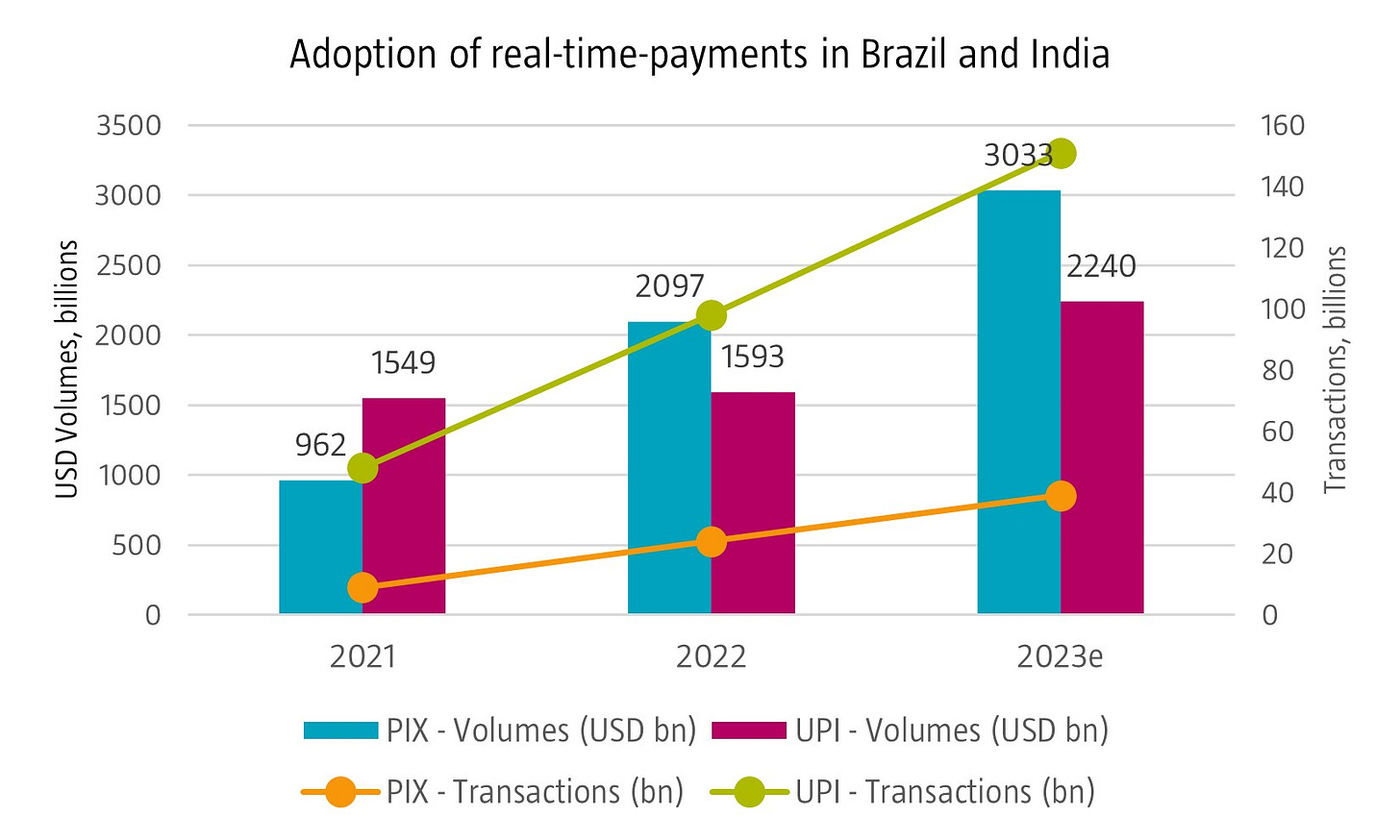

A fascinating attribute of emerging market technology is the pattern of innovation, characterized by the leapfrogging of a technology generation. This attribute allows emerging markets to swiftly embrace newer and more advanced technologies. For instance, in emerging markets, the first telephone many people had at home came in the form of mobile not landline. Digital payments are a prime example of this leapfrog pattern. Real-time payments have grown in several emerging markets well before their release in the US. Digital real-time payments not only leapfrogged established card infrastructure, but also play a pivotal role in promoting financial inclusion and fostering economic growth. In Brazil, two years after the nation’s central bank launched, a real-time digital payment platform called Pix, the service attracted over 120 million customers representing over half the country’s population. In India, UPI provides a similar public, state-sponsored, real-time service, seamlessly integrated into the business model of many local companies engaged in payment processing.

Source: Central Bank of Brazil, NPCI, PCMI Estimates