The mixed six

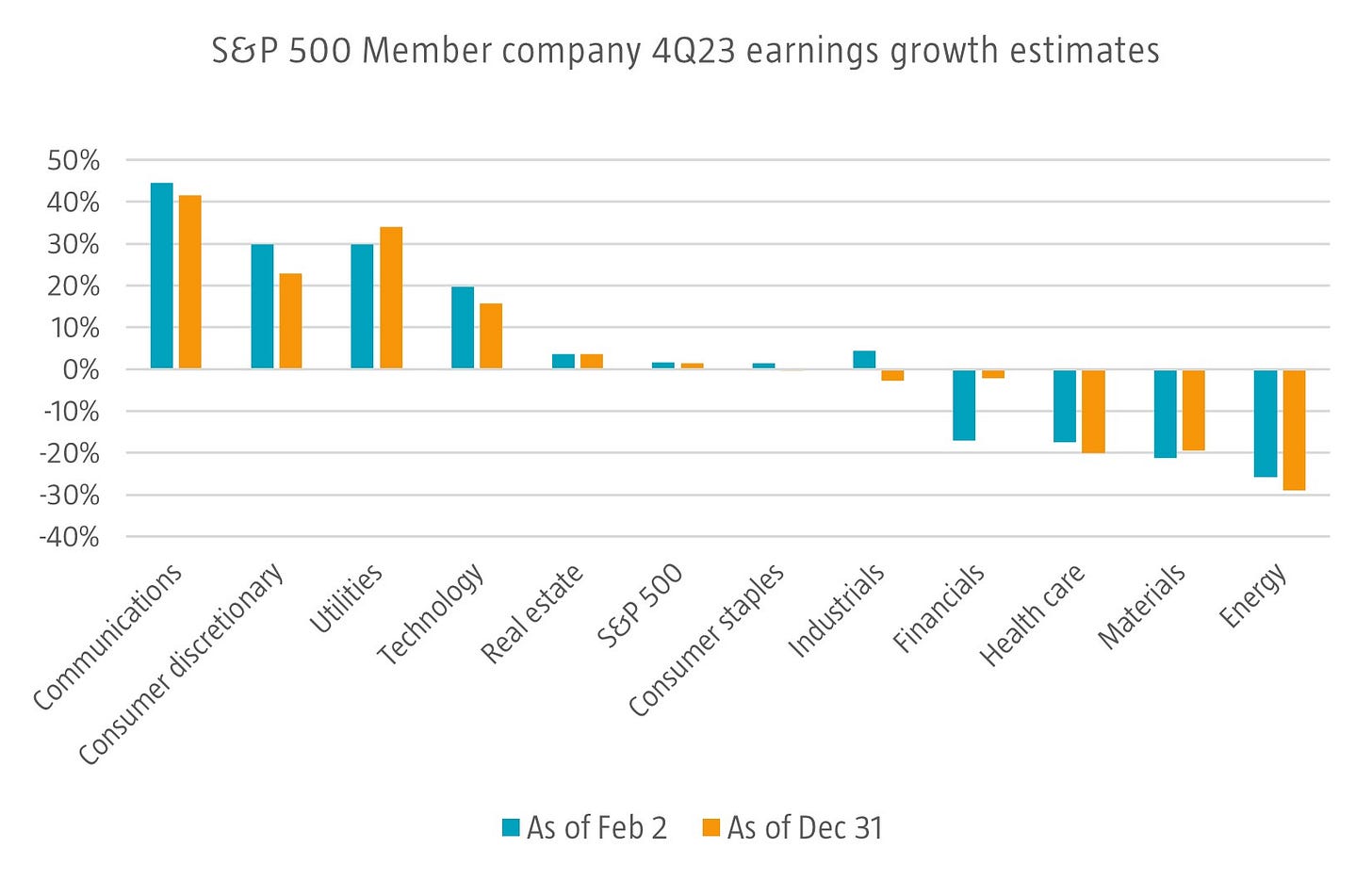

Reflecting on corporate earnings is bit like considering if a glass is half empty or half full. The answer is often a matter of perspective. It is not uncommon for the share price of a company to fall even when its results come in ahead of guidance or analyst estimates. The divergence is sometimes the result of market expectations that are higher than those of published estimates, and sometimes the result of weaker than expected guidance. According to Factset, with 46% of S&P 500 member companies reporting calendar-year 4th quarter 2023 results to date, 72% have reported earnings above expectations and 65% for revenues. So far, six of the Magnificent Seven have reported, and five of those came in ahead of estimates for both earnings and revenues. Nevertheless, only two of those six companies saw their share price rise on the day after results were announced. Notably, the collective earnings of the six rose an impressive 44% year-on-year, compared to the 1.6% earnings growth expected for the S&P 500 as a whole. Nvidia, the remaining of Magnificent Seven, is scheduled to report later this month.

Source: Factset, February 2024.