Sketched, the economy in 2024

Before taking a short holiday break, this week we revisit key trends from the past year across, technology, the consumer, the economy, sustainability, and financials.

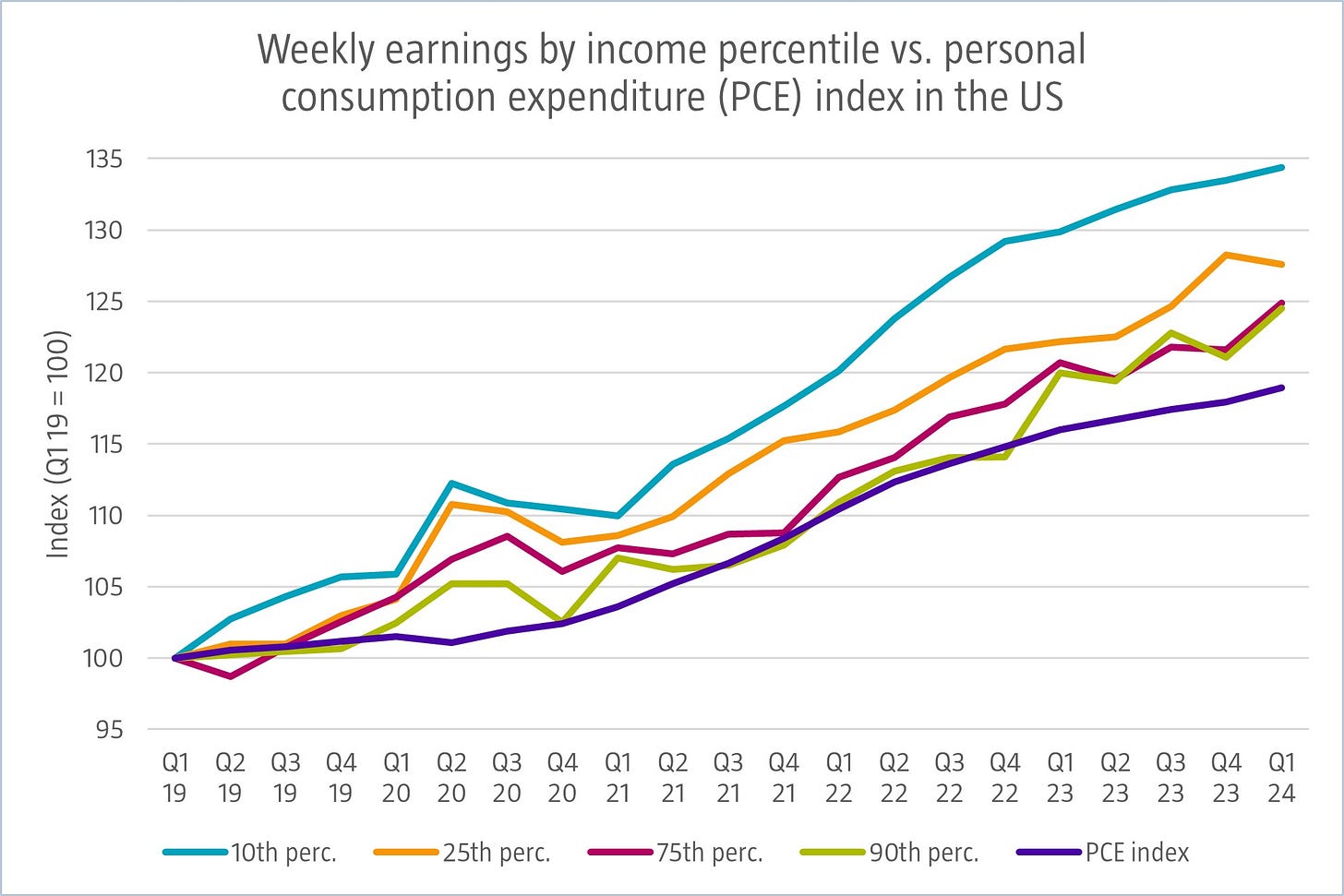

Growth in wages is outpacing increasing prices across the wage distribution in the US. Economists would say consumers are experiencing ‘real wage growth’ i.e., they can buy more goods and services with their earnings.

Source: US Bureau of Economic Analysis, US Bureau of Labor Statistics, April 2024.

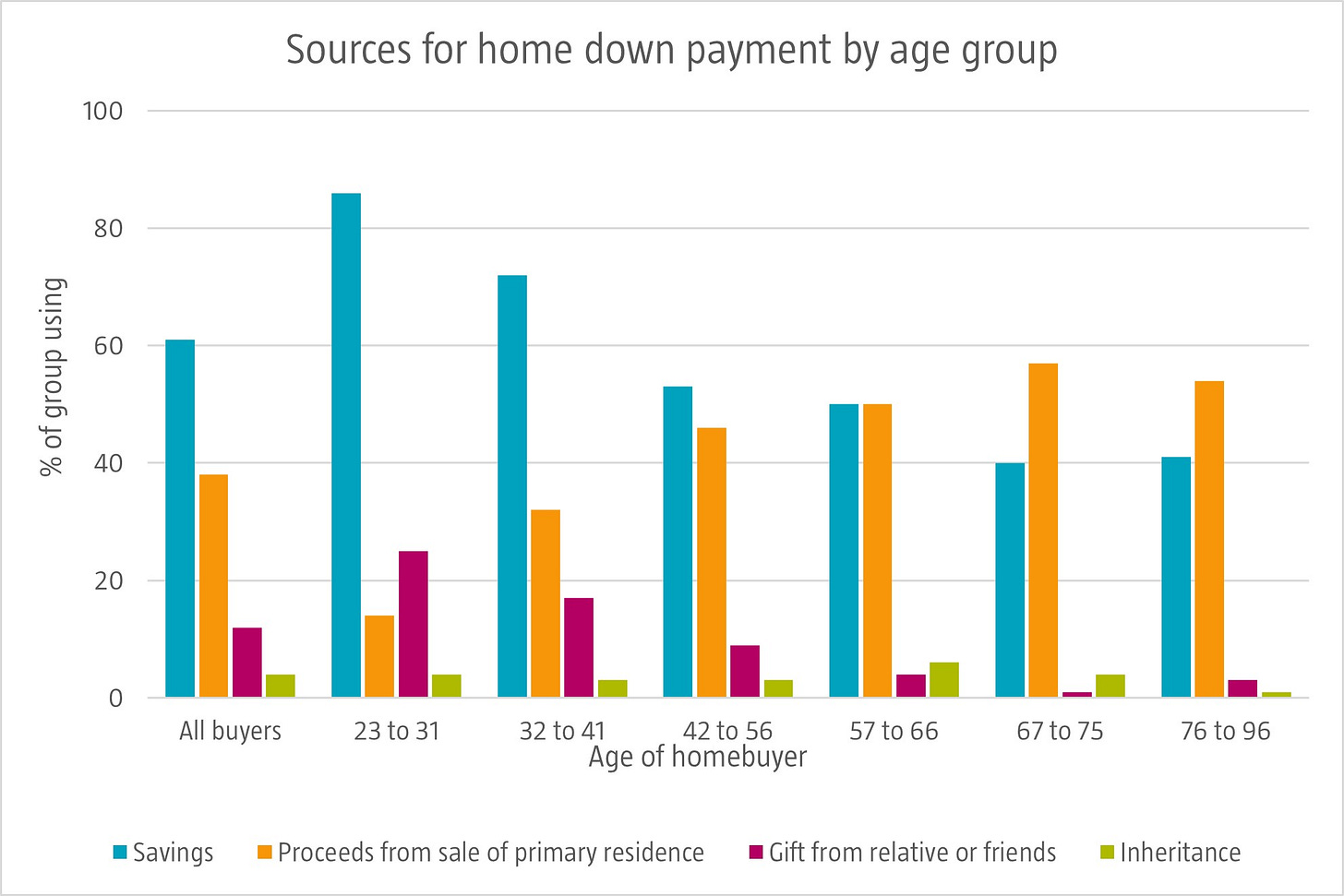

The US is undergoing the largest generational wealth transfer in history. According to global real estate consultancy Knight Frank, over the next 20 years, approximately USD 90 trillion of assets will be channeled from Baby Boomers (born between 1946 and 1964) to Millennials (born between 1981 and 1996) and Gen X (born between 1965 and 1980).

Source: National Association of Realtors, 2022.

Local problems often have a global impact. The re-routing of relevant traffic around the Cape of Good Hope adds time, cost, emissions, and complexity to the journey, straining supply chains. We recently published an article about this topic, read it here.

Source: UN Trade and Development, November 2024.

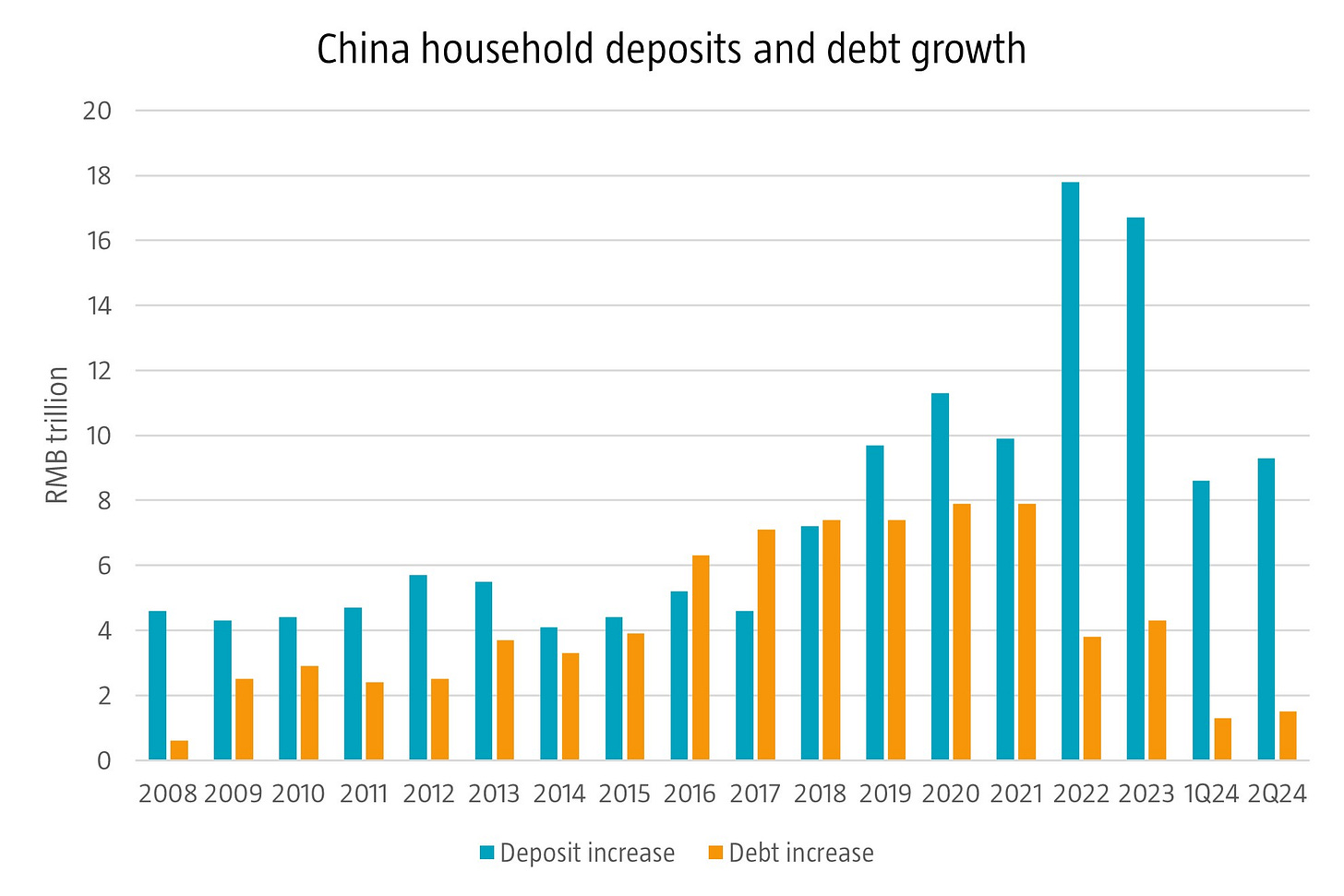

A recent stock market rally in China, sparked by government stimulus measures, was short lived as investors remain wary of deeper structural issues. Nevertheless, with the prospect of further policy adjustments, some investors continue to look for signals to turn bullish again in China.

Source: CLSA, PBOC, WIND, October 2024.

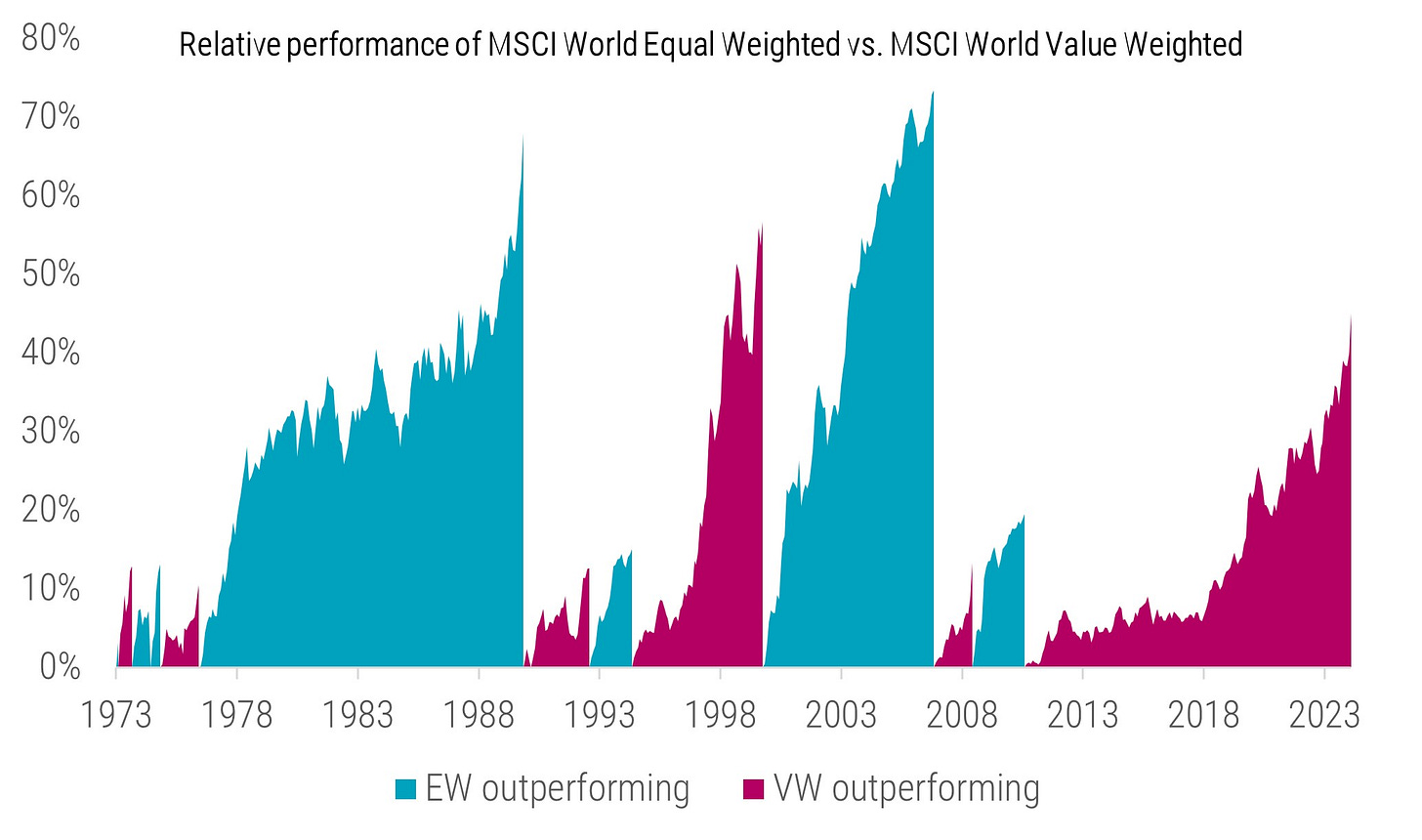

Smaller market capitalization stocks have substantially underperformed their mega-cap counterparts over the last decade. However, according to recent research conducted by our quantitative investment strategies team, a longer term perspective suggests that smaller caps have big potential.

Source: Robeco, LSEG, MSCI. The figure shows the relative performance MSCI World Equal Weighted Index vs. the MSCI World Index. Performance is measured via the total return index and the sample period is May 1973 to June 2024.